(Bloomberg) — Supply Lines is a daily newsletter that tracks global trade. Sign up here.

Most Read from Bloomberg

President Donald Trump’s 25% tariffs on steel and aluminum imports came into force Wednesday, triggering concern across export-reliant Asia and immediate reprisals from the European Union and Canada as the global trade war enters a rocky phase.

The latest US tariffs kicked in after a tumultuous day at the White House, when Trump threatened to double the metals tariffs on Canada to 50%. When Ontario agreed to drop plans to impose a surcharge on electricity sent to the US, he backed off and downplayed the risk of a tariff-led recession that has sent US markets plunging.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or anywhere you listen.

Trump’s latest offensive drew mostly veiled threats against American exports as countries, for now, opted for negotiations to avoid tit-for-tat tariff wars. That lack of a fast and broad escalation presages complex talks in the months ahead over the US’s desire for broadly defined “reciprocal” tariffs set with each country individually.

After a selloff, stocks in Asia and Europe edged higher and US equity futures also rose.

When the deadline passed with no exemptions offered, major Asian producers including South Korea, Taiwan, Japan and Australia held off on immediate retaliation. The UK said it would focus on “rapidly negotiating a wider economic agreement.”

China, which wasn’t explicitly targeted in the latest trade salvo, didn’t immediately respond — but it did summon US retailer Walmart Inc., following reports the US retailer was urging Chinese suppliers to help absorb higher costs.

The European Commission offered the strongest reaction so far and the most details of its next steps. It launched “swift and proportionate countermeasures” on US imports, reimposing balancing measures from 2018 and 2020 and adding a new list of industrial and agricultural goods. The EU’s countermeasures will apply to US goods exports worth up to €26 billion — matching the economic scope of the US tariffs, it said.

“We deeply regret this measure,” European Commission President Ursula von der Leyen said in a statement. “Tariffs are taxes. They are bad for business, and even worse for consumers.”

Canada on Wednesday will announce counter-tariffs on about C$30 billion ($20.8 billion) of US-made products, according to people familiar with the matter. The measures will target steel and aluminum as well as other goods, matching the new US metals levies dollar for dollar, one of the officials said.

Politically, Trump’s move to widen his trade offensive comes at a hazardous juncture seven weeks into his second term. His rapid effort to rewire the US economy as a global manufacturing power has rattled financial markets, spooked consumers still haunted by pandemic-era inflation and fueled recession fears amid mounting uncertainty for corporate America.

Investors largely took the news in stride. Aluminum was up 0.3% on the London Metal Exchange after the tariffs kicked in, while hot-rolled coil — a key steel product — rose 0.4% on the Shanghai Futures Exchange.

Trump pressed on with the metals tariffs despite a flurry of last-minute lobbying from US stakeholders, including the country’s largest aluminum producer, Alcoa Corp. The company warned the tariffs would imperil tens of thousands of jobs while raising prices for Americans already feeling their household budgets squeezed.

The president acted with the backing of some domestic industry executives, who say the protectionist measures could raise profits for US producers and bring steel and aluminum jobs back from overseas.

Steel and aluminum levies are part of Trump’s plan to build significant barriers around the US economy, moves he has cast as necessary to rebalance a global trading system that is “ripping off” the nation. Yet his indecision on some duties has raised questions about his resolve.

Trump last week allowed 25% tariffs to take effect on Canada and Mexico tied to illegal drugs and migration, but within days announced a month-long exemption for goods covered by the North American trade agreement. At the same time, he doubled a similar tariff on China to 20%.

Trump’s steel and aluminum orders revive and expand his 2018 levies on the metals and prohibit exemptions for products made from either of them. That means some $150 billion worth of imported consumer goods get hit with the new tariffs, according to research from Global Trade Alert, in addition to raw steel and aluminum.

Trump’s first administration granted exclusions for major suppliers, including Canada, Mexico, Brazil and the European Union, so that some months, fewer than half of imports were covered by the tariffs. Administration officials have warned not to expect future carveouts.

He has also opened the door to tariffs on copper, a critical mineral for the global economy, by directing the Commerce Department to investigate trade restrictions.

Tariff Anxiety

Anxiety that tariffs and Trump’s government downsizing push will stifle US growth has fueled a three-week stretch of volatility in global markets.

“Traders and investors do feel the heat from these tariffs rising,” said Kok Hoong Wong, head of institutional equities sales trading at Maybank Securities in Singapore. “We are increasingly pricing in an escalating trade conflict.”

Trump’s advisers are crafting so-called “reciprocal” tariffs on trading partners worldwide that could take effect as soon as April 2. He’s also promised duties on automobiles, semiconductors, pharmaceuticals, lumber and agricultural products.

Many US manufacturers have championed Trump’s tariffs on steel and aluminum, arguing subsidized foreign rivals — especially China, producing more than it can consume at home — have unfairly set out to dominate the industry, rob market share and jobs from US suppliers. They argue the metal industry is critical to the US industrial base and national security.

“Strengthening the steel and aluminum tariffs” will help incentivize “companies to boost output, make new investments and hire workers,” said Scott Paul, president of the Alliance for American Manufacturing. “Including derivative steel products makes a lot of sense to ensure that importers can’t game the system and American companies that make these products have a level playing field.”

The nation’s largest steelmakers, including Nucor Corp., United States Steel Corp., Cleveland-Cliffs Inc. and Steel Dynamics Inc, last week urged Trump to “resist” calls for carveouts, warning that previous exemptions prompted a surge of imports, causing prices to drop and their profits to shrink.

Before the exemptions, Trump’s 2018 tariffs helped boost prices — and reduce imports — of both steel and aluminum.

The US steel industry is coming off its worst year since Trump’s first term, as lackluster construction demand, inflation on input materials and high borrowing costs crushed their earnings. While imports rose in 2024, they remained lower than 2022 and 2021. Steel inventories are near a multi-year high, sitting in warehouses awaiting an increase in demand.

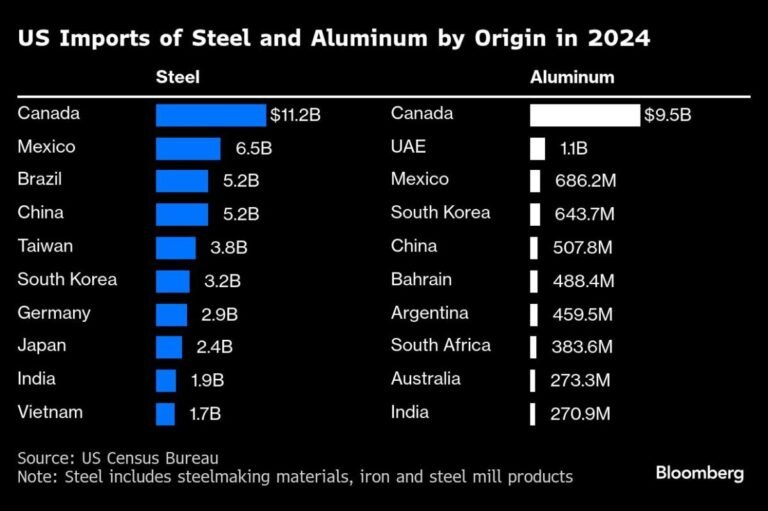

The tariffs present a more complex challenge for the aluminum industry. Unlike American steelmakers, aluminum producers have a greater global footprint. More than half of the metal consumed in the US is made in Canada, where the biggest producers are Rio Tinto Group and Pittsburgh-based Alcoa.

Alcoa Chief Executive Officer William Oplinger, Rio Tinto representatives, the president of the US Aluminum Association and others have recently been directly involved in lobbying the Trump administration to avoid the added tariffs on Canadian imports, according to people familiar with the discussions who asked not to be named because they were private.

Oplinger predicts devastating consequences from a 25% tariff, including the loss of about 20,000 direct US aluminum industry jobs and another 80,000 indirect jobs.

Economists predict the tariffs are likely to drive up costs for some domestic industries that are heavily reliant on foreign supplies of specialty steel. That includes the oil industry, which uses steel pipes and other materials at wells. Higher costs for steel and aluminum also could trickle down to consumers in the form of more expensive automobiles, appliances and even canned drinks.

Supporters of the president’s plan argue the tariffs ultimately will help drive more manufacturing to the US. And while even the president has acknowledged there may be some short-term economic pain from his broader tariff onslaught for US consumers, administration officials say extended tax cuts and more domestic energy production should help offset those costs.

While many countries affected by the fresh tariffs didn’t retaliate, they also weren’t happy about the moves. Australian Prime Minister Anthony Albanese told reporters that the Trump administration’s actions were “entirely unjustified” and an act of “economic self-harm.”

“This is against the spirit of our two nations’ enduring friendship,” Albanese said. “And fundamentally at odds with the benefits that our economic partnership has delivered over more than 70 years.”

–With assistance from Josh Wingrove, Meghashyam Mali, Shadab Nazmi, Katharine Gemmell, Abhishek Vishnoi and Richard Bravo.

(Adds Canada retaliation starting in first paragraph)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.