(Bloomberg) — The excitement over China’s technology development that pushed the nation’s stocks to outshine their global peers has attracted a substantial inflow of money from retail investors at home.

Most Read from Bloomberg

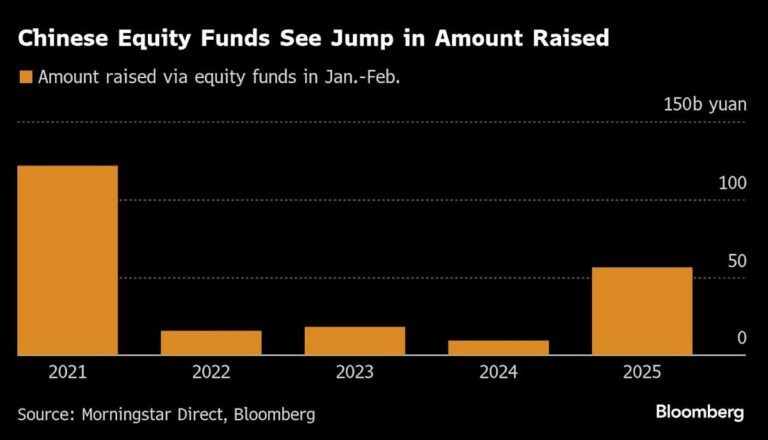

Equity mutual funds raised 56.4 billion yuan ($7.8 billion) in the first two months of the year, a five-fold increase from the same period last year and the biggest amount since 2021, according to Bloomberg calculations based on Morningstar Direct data. The number of such funds launched also jumped 76% year-on-year, the data showed.

The surge in fund inflows underscores growing investor conviction that breakthroughs on the technology front may help counter risks from worsening deflationary pressures and escalation in a trade war with the US. Bullish messages from the just-concluded National People’s Congress also provided investors assurance that Beijing is ready to unveil more stimulus to hit a growth goal of about 5% this year.

Chinese equities have staged a world-beating rally this year thanks to DeepSeek-induced enthusiasm over homegrown artificial intelligence and other advanced technologies. The rally also triggered a strong re-rating of Chinese assets by global money managers including UBS Group AG, Morgan Stanley and JPMorgan Chase & Co.

The tech-heavy STAR50 Index climbed more than 9% in the January-February period, while a gauge of tech shares listed in Hong Kong surged nearly 25%.

As investor risk appetite rises, the number of mixed-allocation and bond-focused funds launched recently has fallen out of favor, however. Hybrid funds dropped by 38% in the first two months of 2025 compared to a year ago, while the number of bond funds fell by 29%, according to the data.

The moves were “driven by a combination of the bottoming of long term domestic bond yields and increased optimism in China equities driven by greater confidence in the long term outlook of China’s tech sector,” said Gary Tan, a portfolio manager at Allspring Global Investments.

–With assistance from Mengchen Lu and Chongjing Li.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.